To download a copy of the Audi Gap Insurance Cover Booklets, simply click on the appropriate link below.

As of the 10th February 2024, you will not be able to purchase a new Audi Gap Insurance policy. If you purchased Audi Gap Insurance prior to this date, please be assured that this does not have any impact on your existing policy.

Audi Gap Insurance and Audi Gap Insurance Plus are administered by Car Care Plan Limited and underwritten by Motors Insurance Company Limited.

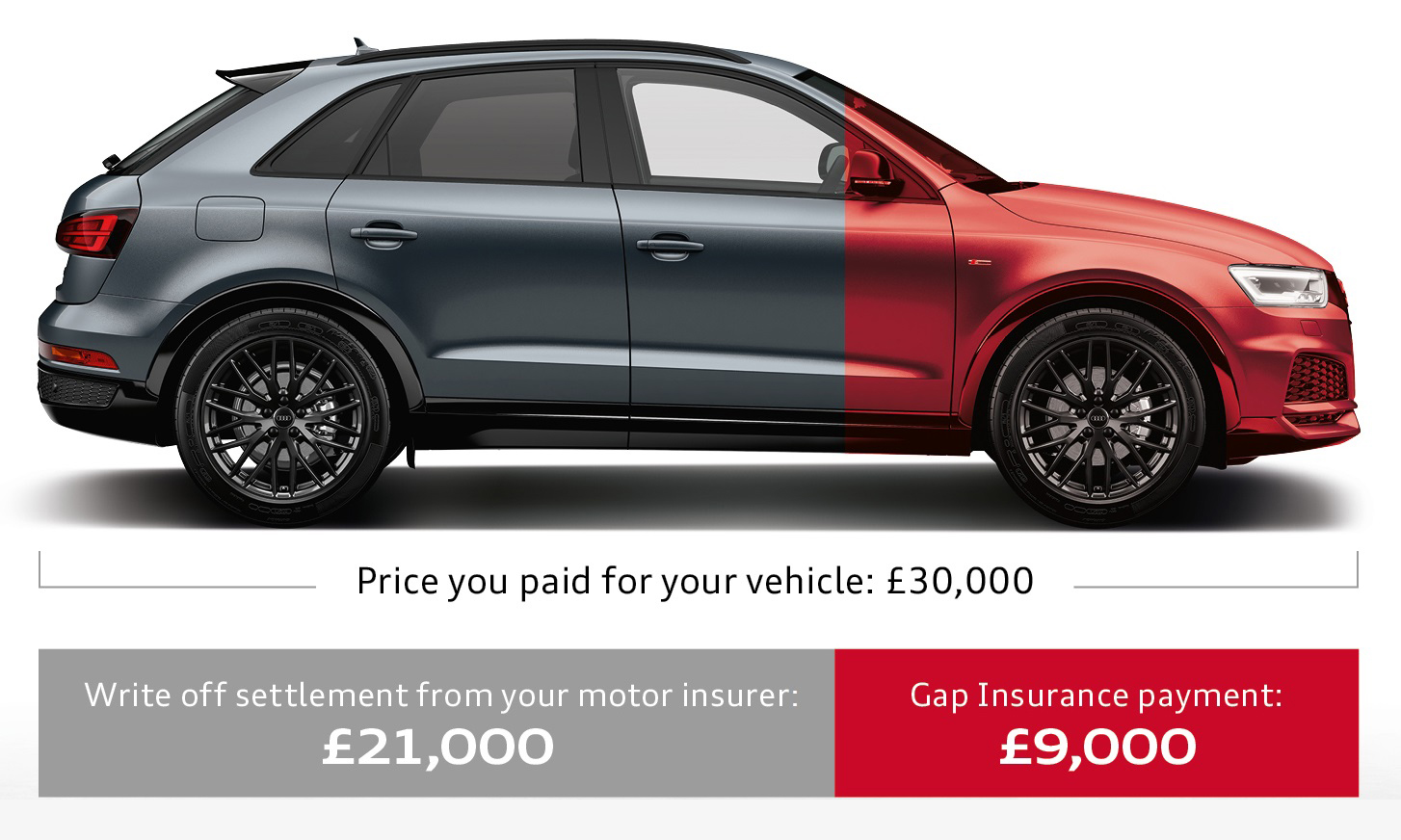

If your Audi is written off, your motor insurer will usually pay out based on the current market value of your vehicle. This could be a lot less than its original value and therefore may leave you with an unexpected shortfall.

Our Gap Insurance helps to cover the gap left by this shortfall to get you back in a new Audi or help pay off any outstanding finance, lease or hire agreement.

Audi Gap Insurance

This pays the difference between the write off settlement from your motor insurer and the price you paid for your Audi or the outstanding balance payable to the finance company, whichever is the greater amount.

If your vehicle is leased or hired, we will cover the difference between the write off settlement from your motor insurer and the early termination charge. This includes any rentals paid in advance as a deposit.

Cover lasts for 36 months and the maximum claim limit is based on your vehicle purchase price.

In the above example, you could receive a £9,000 payment that you could use towards the purchase of a new Audi.

Audi Gap Insurance Plus

In addition to all the benefits of Audi Gap Insurance, the Audi Gap Insurance Plus policy includes a 12-month fixed benefit. This will start once your 36-month Gap Insurance cover ends.

If your vehicle is written off during the additional 12-month fixed benefit period of insurance, we will pay a fixed sum of £2,500 (for vehicles with a purchase price of up to £20,000) or £5,000 (for vehicles with a purchase price of £20,001 or over).

Audi GAP Insurance Cover Booklet

File size

1.5mb

GAP Insurance cover booklet

File size

2.0mb

Please click on the questions below to reveal the answers for policies purchased after 1st January 2021 and administered by Car Care Plan Limited.

For policies purchased before 31st December 2020, please refer to your Cover Booklet for relevant information.

As of 10th February 2024, you are not able to buy Audi Gap Insurance. Any policies activated before this date will remain in force according to the terms and conditions in your Cover Booklet.

Please check your motor insurance policy for details of cover. Some motor insurers may provide a replacement vehicle if yours is written off however, this is different to Gap Insurance.

In the event that your vehicle is declared a total loss by the motor insurer, whereby the motor insurer has provided you with a replacement vehicle or your vehicle is replaced under a manufacturer's or Audi Centre's warranty, you may transfer this policy to the replacement vehicle subject to the following terms and conditions:

- The total loss has occurred within 12 months of the start date of this policy;

- The replacement vehicle must have been provided by the motor insurer in settlement of a claim for the total loss of your vehicle;

- The start date of the policy will remain the same;

- The period of insurance will remain the same; and

- You have not made a claim under your policy relating to your vehicle or motor insurance excess.

If you have taken out a finance agreement to purchase your vehicle, the purchase price of your original vehicle will be used to calculate any future claim under this policy, irrespective of whether the purchase price of the replacement vehicle is higher or lower than your original vehicle.

For full details on how to transfer your policy, please refer to your Cover Booklet.

If you consider your vehicle is likely to be declared a total loss, here’s what to do:

- Access the Customer Portal;

- Email: gapinsuranceclaims@audi-insurance.co.uk; or

- Contact the Administrator on: 0344 573 7560.

You will need to tell us within 120 days of your total loss occurring. When notifying us, you will need to have the following information:

- Your policy number; and

- Your details as recorded on the schedule.

The Administrator may arrange for one of its representatives to visit you to help investigate your claim.

Important - Please contact the Administrator in order to register your claim prior to agreeing any settlement offer from your motor insurer. You should maintain any loan or finance payments that are due whilst your claim is being assessed by us.

For full details on how to make a claim, please refer to your Cover Booklet.

If there is a change to any of your details that you provided when setting up your policy, you should contact the Administrator as soon as possible.

- Email: customerservice@audi-insurance.co.uk

- Phone: 0344 573 7560

We hope that you will be pleased with the service we provide. In the unlikely event of a complaint, you should contact the Administrator.

- Phone: 0344 573 7560

- Post: The Audi Gap Insurance Customer Service Manager, Car Care Plan Limited, Jubilee House, 5 Mid Point Business Park, Thornbury, West Yorkshire BD3 7AG.

- Email: complaints@audi-insurance.co.uk

Please contact the Audi Centre from which you purchased your Audi Gap Insurance policy, contact the Administrator or visit the Customer Portal to get your replacement documents.

- Email: customerservice@audi-insurance.co.uk

- Phone: 0344 573 7560

If this policy does not meet your needs, you have 30 days from the date you received your policy documents to cancel the policy and obtain a full refund. To cancel your policy within this 30-day period, please contact the Audi Centre who sold you your policy.

If you wish to cancel your policy after this 30-day period (during the 36-month Gap Insurance cover), you can cancel at any time and receive a pro rata refund, subject to a cancellation fee of £20.

Please note, if you have taken out Audi Gap Insurance Plus and you cancel before the inception of the 12-month fixed benefit period of insurance, you will receive a full refund for the 12-month fixed benefit portion of your premium and a pro rata refund on the remaining duration of your 36-month Gap Insurance cover, subject to a cancellation fee of £20. If you cancel during the 12-month fixed benefit period of insurance, you can receive a pro rata refund on the 12-month fixed benefit portion of your premium (as detailed in your schedule), without a cancellation fee.

The percentage refund will be calculated from the date your request to cancel is received. An administration fee of £20 will be deducted from the calculated amount prior to any refund being paid.

To cancel your policy after 30 days of your cover start date, please contact the Administrator.

- Phone: 0344 573 7560

- Post: The Audi Gap Insurance Customer Service Manager, Car Care Plan Limited, Jubilee House, 5 Mid Point Business Park, Thornbury, West Yorkshire BD3 7AG.

- Email: customerservice@audi-insurance.co.uk

For full details about cancelling your policy, please refer to your Cover Booklet.